XAUUSD hit a record high again

On Monday, XAUUSD continued climbing and broke above the US$2900 mark to a record high again. It ended up 1.66% at US$2907.55 per ounce.

Risk aversion boosted XAUUSD

On Monday, as the US imposed the tariff increase on trading partners’ goods, concerns on global economic growth escalated, boosting XAUUSD.

Gold ETF holdings increased

As of the 10th February, gold holdings reached 871.08 tons, an increase of 2.58 tons over the previous trading day, according to the world’s largest Gold ETF——SPDR Gold Trust.

The bullish market trend was strong in the short term

the Chart of the Day

the Chart of the Day

On the chart of the day, XAUUSD continued climbing. The bullish market prevailed in the short term. Technically speaking, MACD went upwards after golden cross occurred, showing XAUUSD will rise further. Investors should focus on whether XAUUSD will break through the resistance at 2950. It will rise further with potential resistance at around 3000 if it breaks above 2950.

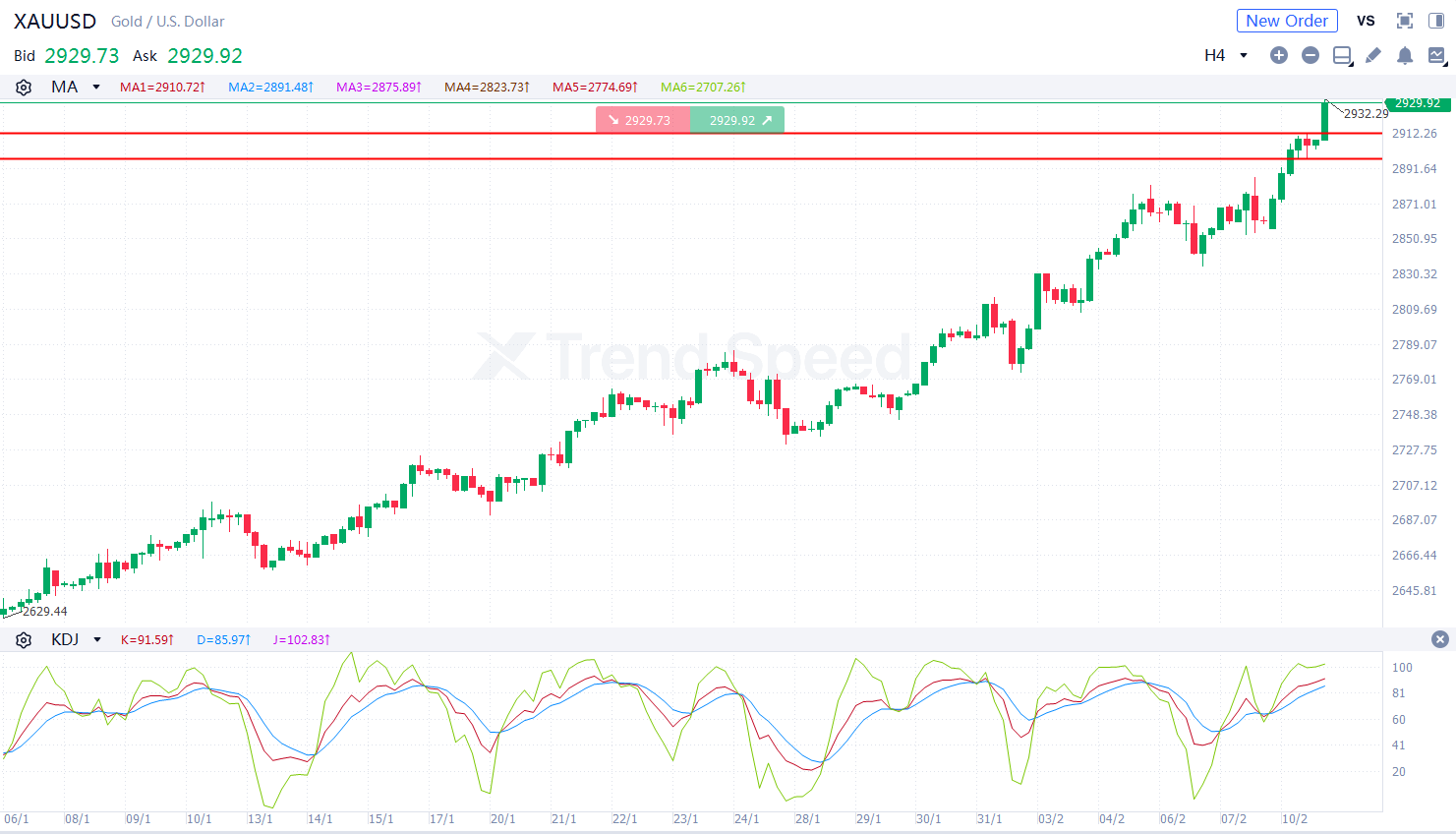

4-hour chart

4-hour chart

On the 4-hour chart, XAUUSD was prone to fluctuation and climbed. The bullish market trend prevailed. In terms of technical indicators, KDJ went upwards after golden cross occurred, showing that the market trend is bullish. Investors should focus on whether XAUUSD will break through the support at 2911. It will jump further if it retreats but is stable above 2911.

Key resistance: 2950, 3000

Key support: 2911, 2896

Generally speaking, the gold market trend is bullish. Investors should focus on speeches delivered by the Fed officials during the day.